The 3X Growth Process

Generate Better Lending Terms and Faster Portfolio Growth

How the 3X Growth Process Can Help

The 3X Growth Process is a 4-step method used by commercial real estate operators to close deals 3X bigger than they have to-date.

Litmus

Testing

Objection

Smoothing

Loan

De-Risking

Fact

Filtering

Litmus Testing

[ LITMUS TESTING ]

Many operators struggle to convince lenders they have a sensible business plan, understand their deal’s key risk factors, and how to manage them effectively. This is how we convince them.

“Litmus Testing helps operators “look the part” of highly seasoned real estate professionals by identifying weaknesses in their business plans, bios, and operations, and outlining a strategic plan to mitigate these issues before approaching lenders.

There are 4 components to our Litmus Testing process:

Sponsor Doc Analysis & Enhancement

Property Doc Analysis & Enhancement

Strengths & Weakness Summation

Risk Mitigation Plan

Objection Smoothing

[ OBJECTION SMOOTHING ]

There’s a pronounced difference between knowing your business plan “in general”, knowing the plan of execution, and knowing how you intend to mitigate all of the risks. Get this right, and you will receive faster lender response times, increased lender interest, fewer lender rejections, more negotiating leverage, and better loan terms.

There are 5 components to our Objection Smoothing process:

Perform Objection Analysis

Create Two-Tier Response Vault

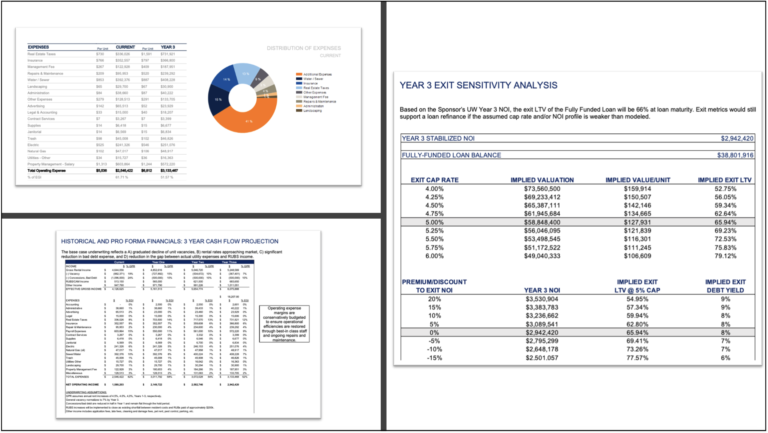

Prepare Offering Memo

Address Lender Inquiries

Conduct Real-Time Objection Management

Loan De-Risking

[ LOAN DE-RISKING]

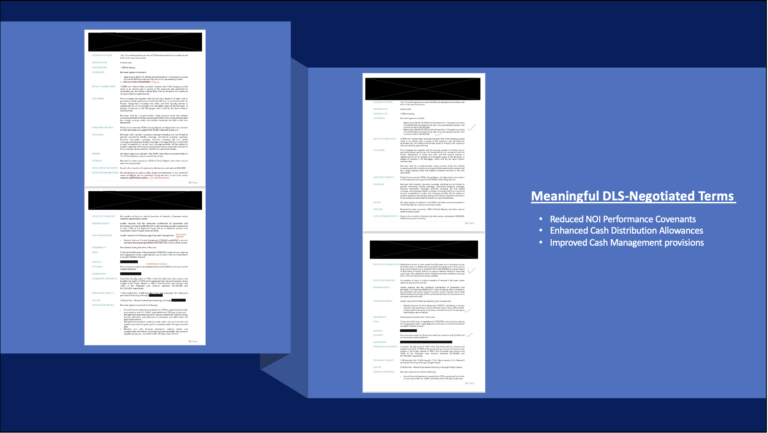

The DLS Loan De-Risking Process is a 4-step method that has proven to generate better financing terms and/or improved loan pricing.

There are 4 components to our Loan De-Risking process:

Term Sheet Review & Analysis

Needs vs Wants Assessment

BATNA Strategy Session

Term Sheet Negotiation

Fact Filtering

[ FACT FILTERING ]

“Fact Filtering” is the process of making sure you don’t overshare or say anything that can get your loan offer pulled.

There’s a thin line between being transparent and oversharing. Getting through a lender’s due diligence process is a nuanced ballet of timing, accuracy, presentation, and discernment. Disclosing a piece of information too soon, too late, that wasn’t necessary, or not at all can be the difference between a “Yes” and a “No”. In this regard, our clients call us the “cheat code” because we know the answers to the test.

There are 4 components to our Fact Filtering process: